June 19, 2025 2:21AM

Skincare Market Report Malaysia 2025 | Trends, Insights & Strategies

The skincare industry in Malaysia is undergoing a quiet revolution. As consumer lifestyles continue to evolve and climate-related stressors intensify, the way Malaysians approach skincare is changing in both subtle and significant ways. Rising temperatures, persistent humidity, and growing environmental concerns are prompting consumers to seek products that offer more than just beauty benefits. They are increasingly prioritising protection, hydration, and sustainable formulations that suit their daily realities.

At the same time, the digital landscape is transforming how skincare products are discovered, evaluated, and purchased. Consumers today engage with multiple touchpoints, moving seamlessly between e-commerce platforms, social media storefronts, pharmacies, and physical retail spaces. They expect fast access to products, reliable information, and a sense of trust in the brands they choose.

In this rapidly evolving environment, companies can no longer rely on assumptions or outdated strategies. Understanding what Malaysian consumers buy is no longer enough. Businesses need to uncover the deeper motivations behind these purchases, learn where people are shopping, how they are making decisions, and which brands are capturing their loyalty.

To support these goals, Vodus Research conducted a nationwide survey involving over 1,000 Malaysian respondents between 17th January and 17th February 2025. Data was gathered through the Vodus Media Network, which includes leading platforms such as Astro, Media Prima, and Star Media, covering both Peninsular and East Malaysia. This research provides a comprehensive view of the market, uncovering critical insights into consumer behaviour, purchase drivers, preferred channels, brand awareness, and growth opportunities.

What’s Inside the Report

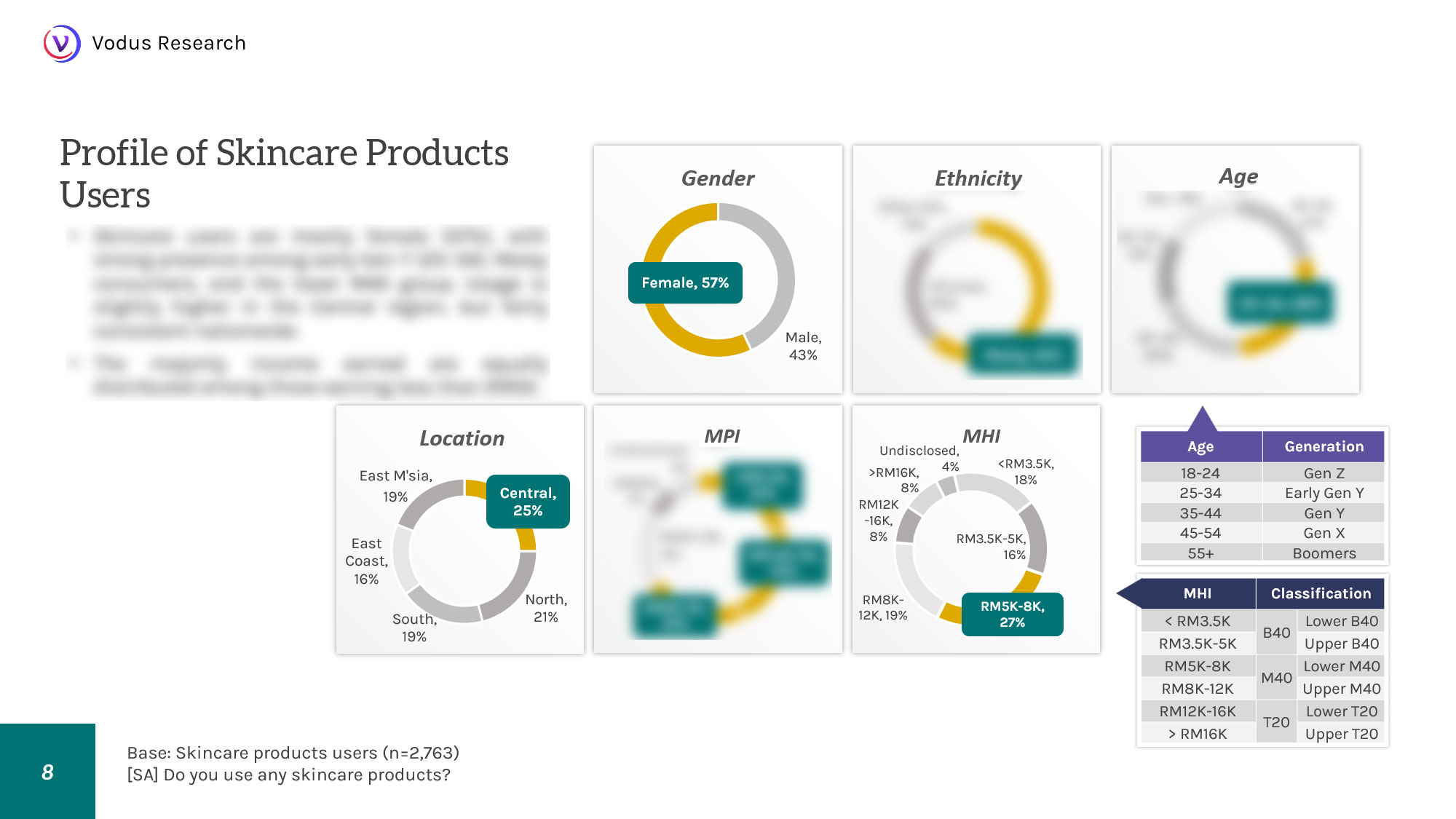

- Profile of Skincare Users in Malaysia - The report begins with a detailed profile of skincare users in Malaysia, providing a demographic overview and a breakdown of skin types across the population. It also introduces key consumer personas that reflect different attitudes, routines, and motivations driving skincare habits today.

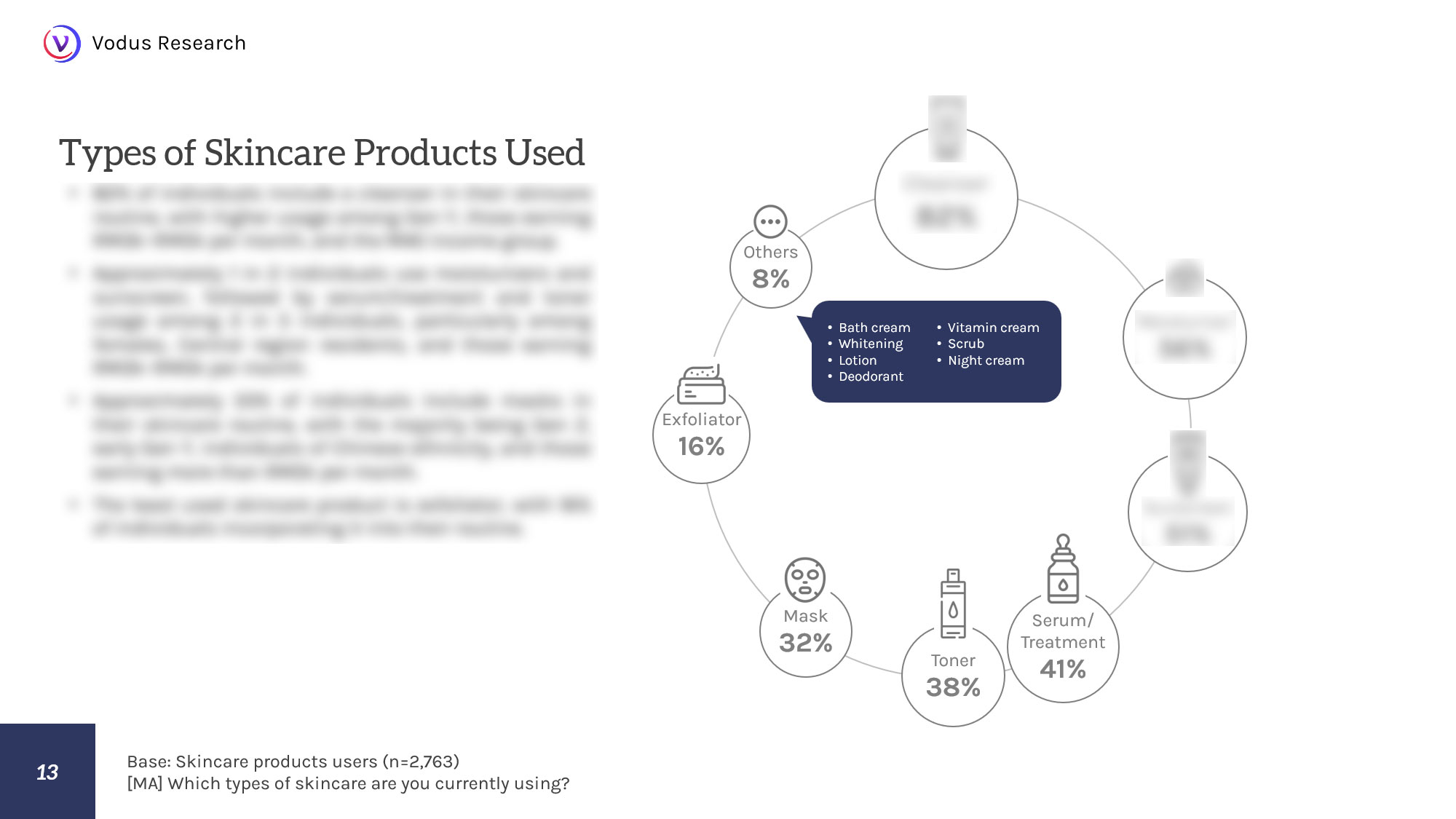

- Skincare Habits and Product Usage - We explore how skincare routines vary by skin type, the types of products used, frequency of application, and the number of different brands or product variants tried in the past month. These insights reveal the diversity of skincare practices among Malaysian consumers and the mix of products they incorporate into their routines.

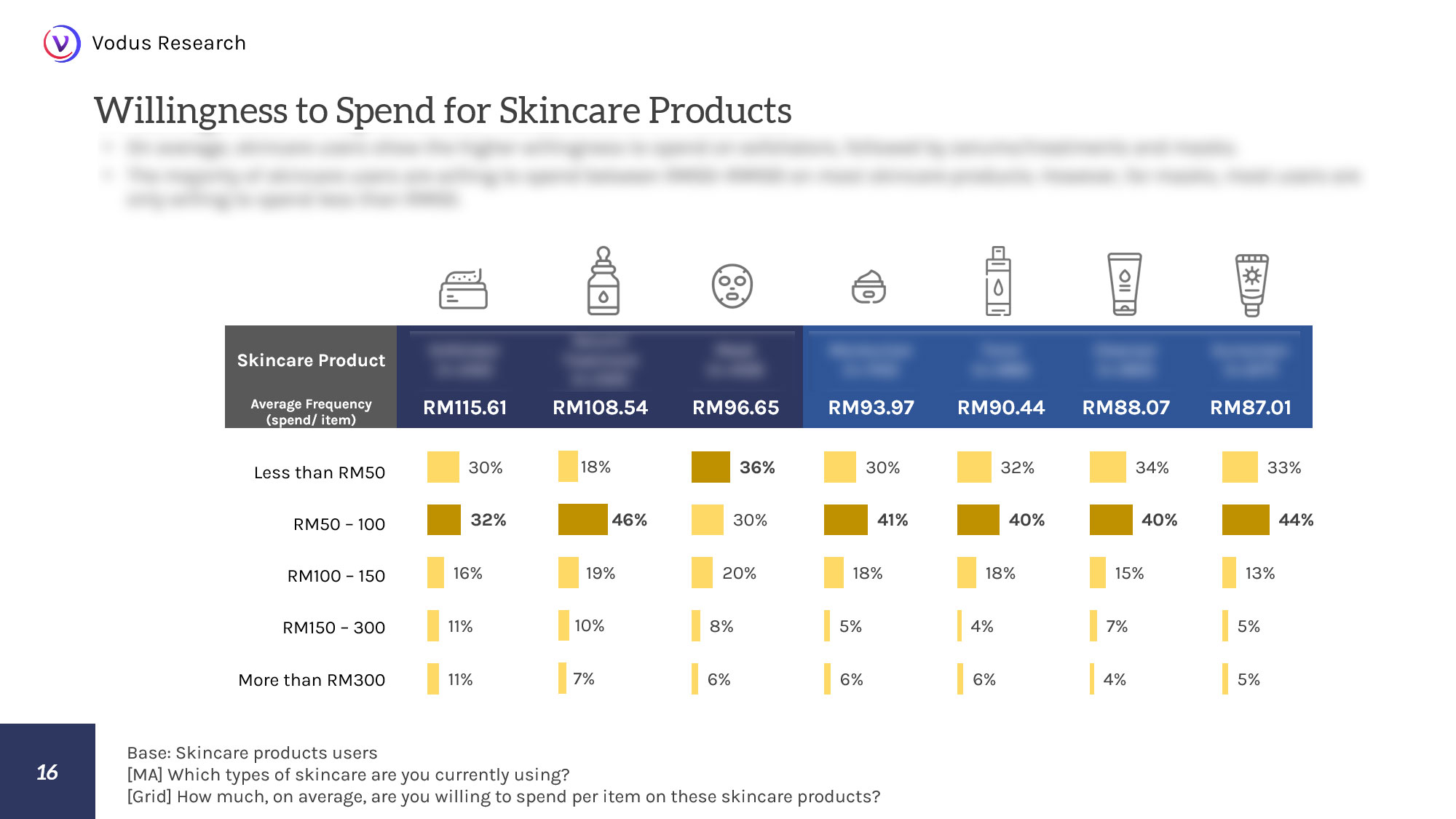

- Spending Behaviour and Future Intentions - This section analyses how much consumers are willing to spend on skincare and whether they expect their usage to increase in the near future. It highlights patterns in value sensitivity, premium spending, and openness to trying new products across different user groups.

- Desired Benefits and Brand Choice Drivers - Here, we uncover the most sought-after benefits in skincare — such as hydration, brightening, acne control, and anti-aging — and examine the key factors that influence brand choice. Elements like product effectiveness, safety, trustworthiness, and ingredient transparency are explored.

- Purchase Channels and Information Sources -We delve into where consumers are buying skincare products — whether through online platforms, pharmacies, social commerce, or brick-and-mortar retail — and what sources of information they rely on when making purchase decisions. The report also explores how these channels and sources interact to influence the final point of purchase.

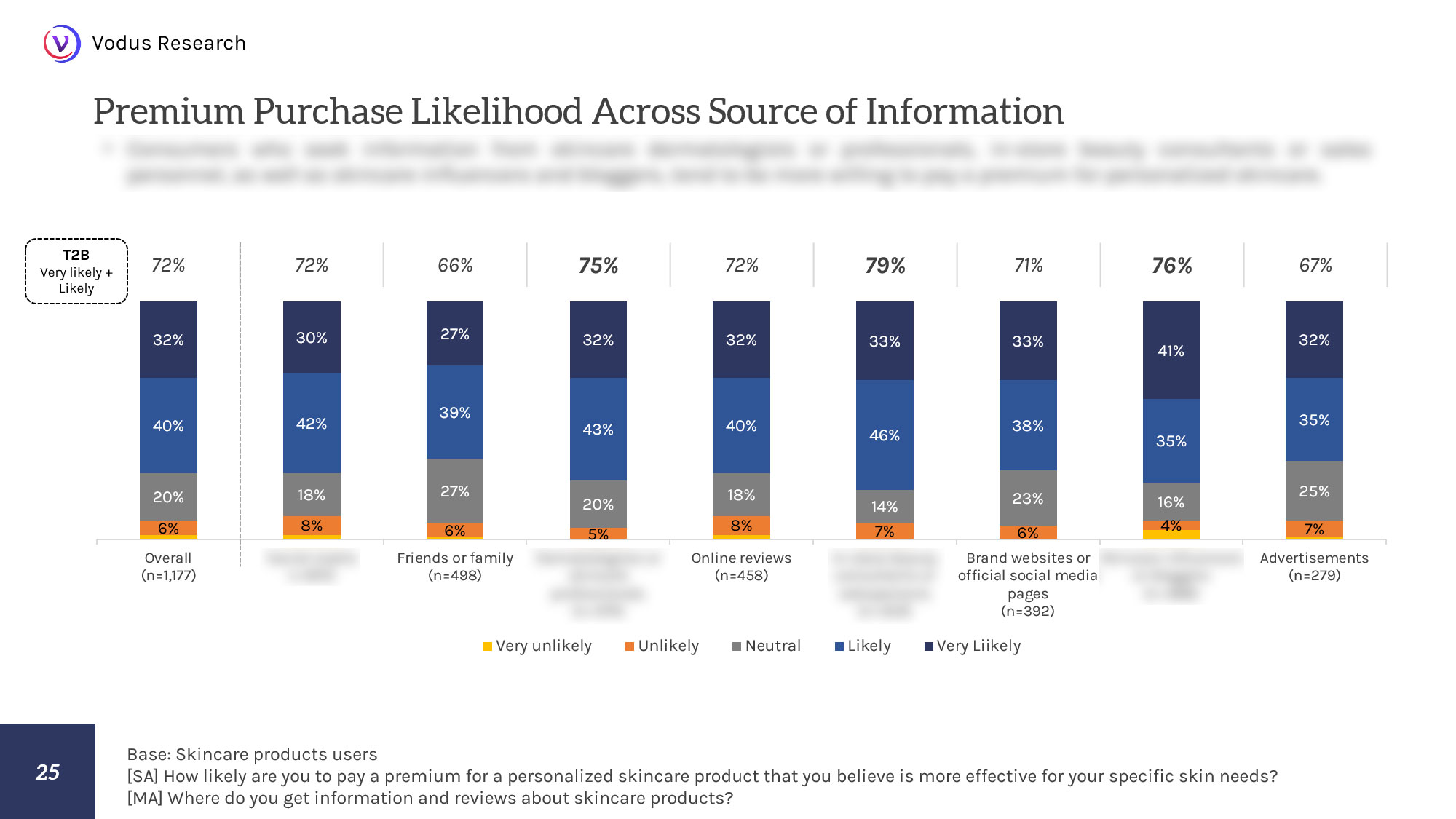

- Trial, Premium Behaviour, and Personalisation - This section investigates the motivations behind trying new skincare products and consumers’ willingness to pay more for personalised skincare solutions. It also compares premium spending behaviour across different information sources and motivating factors.

- Skincare Behaviours and Usage Attitudes - Beyond product choices, we explore the attitudes and emotions that shape how consumers engage with skincare. This includes special occasions when premium skincare usage increases, such as during weddings, festive seasons, or major life events.

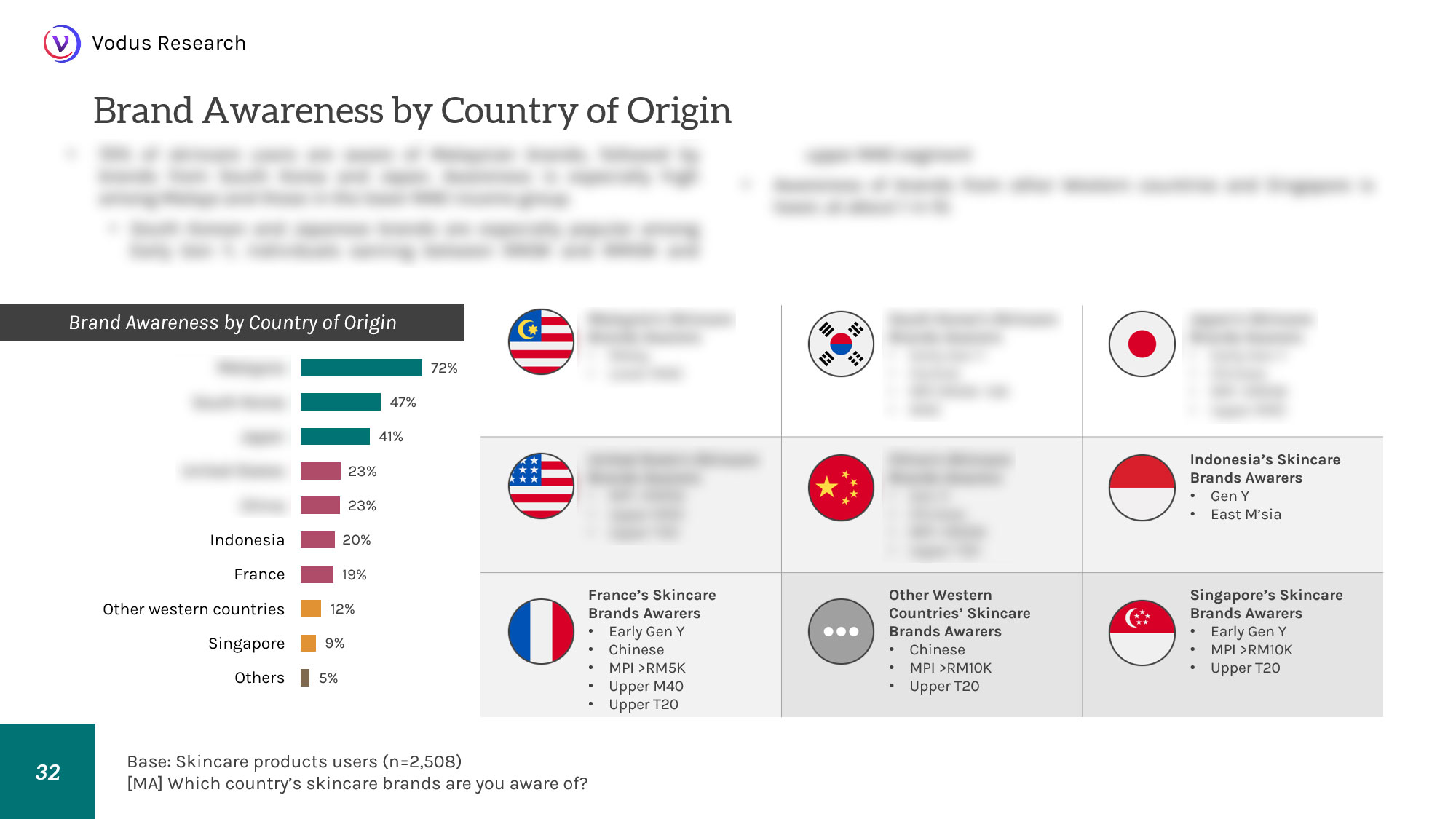

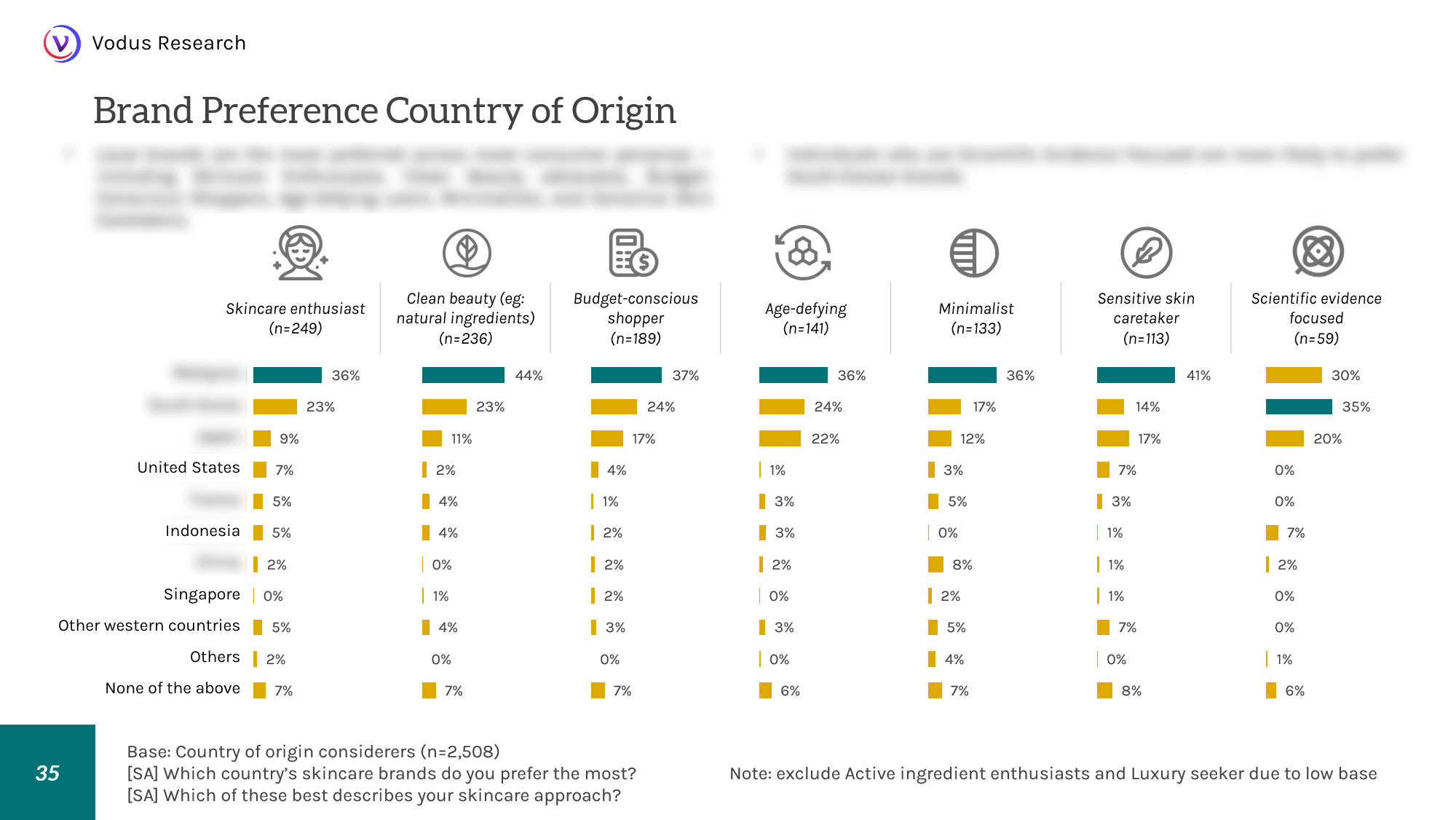

- Impact of Country of Origin - The report examines how the country of origin influences consumer perceptions of skincare brands. We evaluate awareness, consideration, and preference for products from Malaysia, South Korea, Japan, the USA, China, Indonesia, France, Singapore, and other Western countries, identifying the strengths and associations linked to each origin.

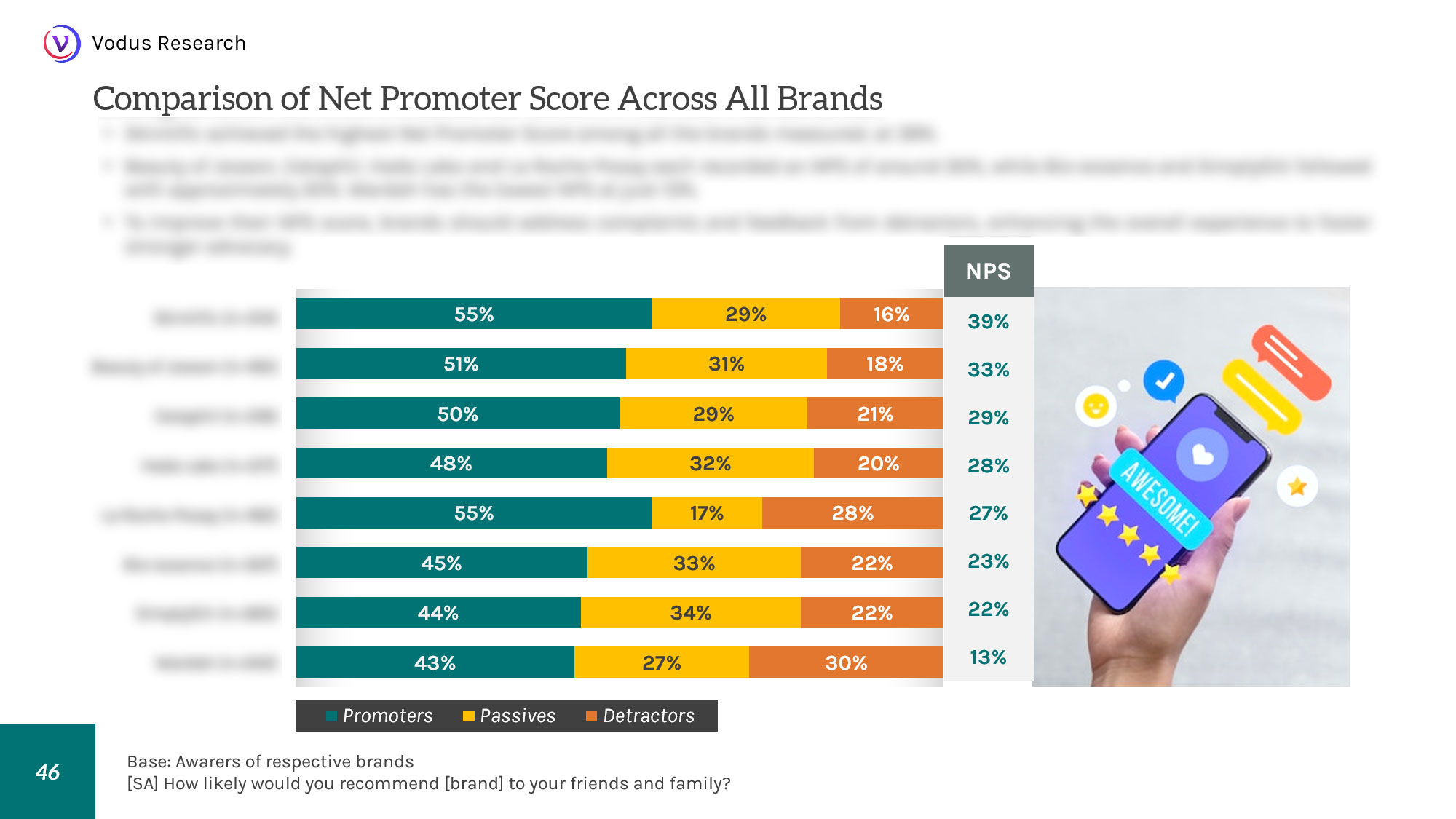

- Brand Performance and Consumer Perception - We assess the performance of both local and international skincare brands through metrics such as brand imagery and Net Promoter Scores (NPS). Featured brands include Bio-essence, Skintific, Cetaphil, Hada Labo, Wardah, SimplySiti, Glad2Glow, Garden of Eden, Beauty of Joseon, La Roche-Posay, CeraVe, ALIA, SomeByMi, and Somethinc. The report compares how these brands are positioned in terms of consumer trust, relevance, and satisfaction.

Summary and Strategic Recommendations

The report concludes with a summary of key findings and practical recommendations for brand owners, marketers, and retailers. These insights are designed to support data-driven strategies for growth and differentiation in Malaysia’s competitive skincare landscape — whether for homegrown players or global entrants.

This report is designed to equip brand leaders, retailers, and marketers with the information they need to make confident, data-driven decisions in a competitive and increasingly complex skincare market.